Italian arms exports: the growth of authorisations continues, while the amendment to Law 185/90 could crumble transparency

More than 6.3 billion of authorisations for the sale of Italian arms abroad: exports to authoritarian countries, countries with human rights violations and to the Ukraine at war continue. If the amendment to Law185/90 currently under discussion is confirmed, the 2024 report could be the last annual report with a good degree of transparency

The Annual Report covering the year 2023 on the operations authorised and carried out for the control of exports, imports and transit of armaments materials was submitted to Italian Parliament (and then published on the website of the Senate of the Republic) at the end of March 2024. A document required by Law 185/90, which regulates arms exports, and which this year arrived by the legal deadline (31 March), unlike what has happened in recent years that have seen delays of up to months. A fact that the Italian Peace Disarmament Network records positively, giving credit to the Meloni government for having healed a serious vulnus. The timing more in line with the normative dictate should now allow Parliament to activate a path of serious and in-depth discussion on the data in the Report, unlike what has happened in recent years. We recall that Parliament’s role of control and direction on a sensitive issue like the export of weapons systems is one of the pillars of Law 185/90 and must be defended as an important prerogative of Senators and Deputies. Rete Italiana Pace e DIsarmo urges, as it has always done, such a path and remains available to provide elements of analysis and evaluation.

ITALIAN ARMS EXPORTS IN 2023

Last year, the total value of licences issued for the transfer of armament materials was of 7,56 billion €: 6,31 billion € were for exports and 1,25 billion € for imports (excluding intra-EU/EEA movements). Compared to the previous year (2022), the significant rise in individual export authorisations (i.e. those issued to individual countries for specific weapon systems) should be emphasised, which increased by over 24% for a total amount of 4,766 billion Euro. The growth trend is also confirmed as relevant for global licences (both project and transfer) for structured co-productions with EU-NATO countries: +37% for a cumulative value of just under 1,5 billion €. As usual, the not very clear, in their nature, intermediation licences showed a swinging trend with the reduction from 397 million to around 87 million € compared to 2022 (but with a figure in line if not higher than previous years). The growth in the two major types of authorisations is obviously reflected in the overall figure, which brings an increase in Italian military exports from €5.289 million € in 2022 to €6.311 million € in 2023. There were 82 countries of destination authorised in 2023, a figure in line with previous years (there were 84 in 2022).

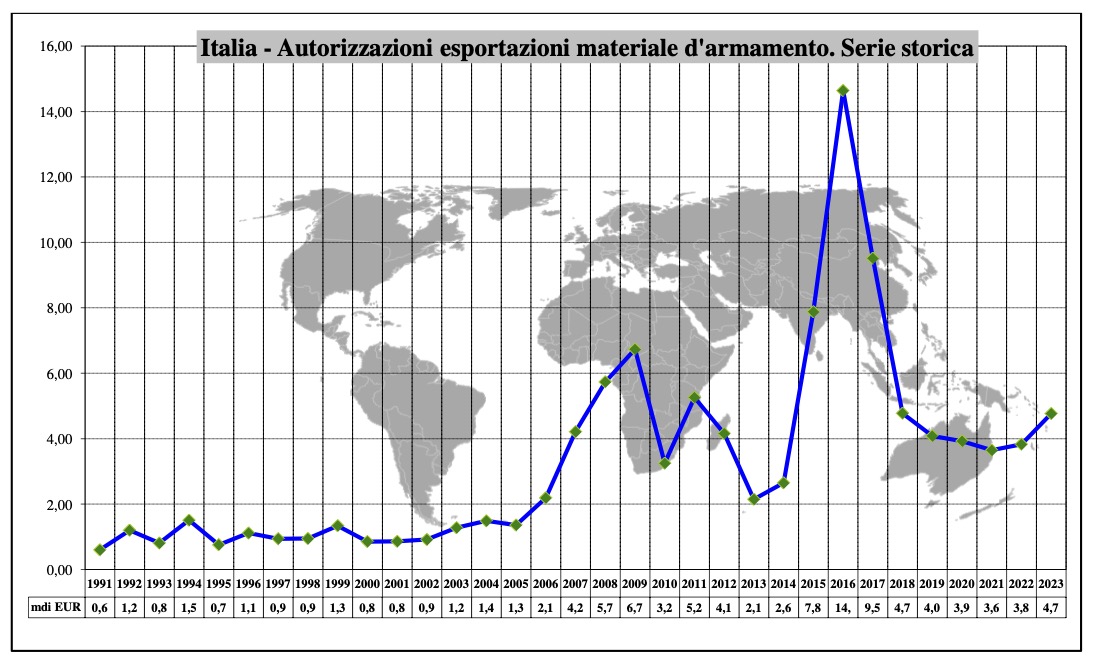

These are numbers that confirm the trends also highlighted by recent SIPRI assessments (based on multi-year indicators capable of ‘spreading’ the effect of the licences issued in each individual year), which showed a significant increase in Italy’s international arms trade of 86% when comparing the last two five-year periods.

The figures that can be obtained from the Reports under Law 185/90 show a structural and continuous growth in the export capacity of the Italian military industry, although we are not at the record levels of the three-year period 2015-2017 (characterised by the ‘mega orders’ for air and naval weapons systems to the petro-monarchies of the Persian Gulf).

The ever-increasing value of licences granted is also reflected in the figures for actual deliveries of weapon systems (which obviously take place on a longer timescale than when the licence document is granted). In 2023, final exports had a countervalue of 4,63 billion €, down from 5,5 billion in 2022 € (logistical effects count here), but still at a level well above the average usually recorded before 2021. Considering also Temporary Exports and Re-Exports, the overall total of the counter-value of arms leaving Italy in 2023 stands at 5,15 billion Euro (it should be noted that this is a significantly lower figure compared to the ‘estimates’ of the value of military exports released by the industry…).

THE RECIPIENTS OF ITALIAN ARMS IN 2023

With regard to recipient countries, the same dynamic as in recent years is confirmed for 2023, with fairly distributed totals (similarly to the fact that no individual authorisations of large countervalue were recorded) and a certain balance between EU/NATO and non-EU/NATO countries in the top positions of the list.

As many as 14 recipient states recorded more than 100 million € in total licences: in first place was France (EUR 465 million) followed by Ukraine (EUR 417 million), the United States (EUR 390 million) and Saudi Arabia (EUR 363 million). All other countries have totals of less than 300 million € and among the top recipients, states such as Turkey (231 million in licences), Azerbaijan (156 million) and Kuwait (125 million) are of concern (due to the type of government or involvement in armed conflicts and human rights violations).

Obviously, the large number of licences (15 in total for a total of 417 million) issued to Ukraine stands out in this list, which in previous years was hardly ever on the list, given the ongoing conflict situation following the Russian invasion in February 2022. It is astonishing that such authorisations were granted to a country that is clearly in a state of war, despite the clear criteria in this regard not only of Law 185/90 but also of the ATT Treaty and the EU Common Position that are binding on Italy. It should be noted that, unlike what happened with the (unnecessary) derogation of Law 185/90 voted several times by Parliament in the context of the measures that authorised the direct transfer of armament materials by the Italian Government to the Ukrainian Government, there are no similar parliamentary votes in the context of remunerated exports granted to Italian companies (as provided for by law and in our opinion necessary in cases such as this).

The Report does not, as usual, provide further details on the specific weaponry authorised for use in Kiev, which, however, appear to be in the following categories

002 WEAPONS OR WEAPON SYSTEMS WITH A CALIBRE GREATER THAN 12.7 MM

003 MUNITIONS

005 FIRE CONTROL EQUIPMENT

006 LAND VEHICLES

007 TOXIC, CHEMICAL OR BIOLOGICAL AGENTS, TEAR GASES, RADIOACTIVE MATERIALS

008 EXPLOSIVES AND MILITARY FUEL

011 ELECTRONIC EQUIPMENT

The notes provided by the UAMA Unit within MFA then go on to address the specific case of Israel, highlighting how ‘in 2023, the value of authorised exports (9.9 million) remained stable compared to the previous year, while the value of imports grew significantly, reaching 31.5 million (seventh place among countries of origin)’. And also how ‘the characteristics of the Israeli action on Gaza in reaction to the criminal assault conducted by Hamas after 7 October 2023 have led to a particularly cautious assessment of the granting of new authorisations to Israel. As is well known, the granting of new authorisations for the export of armaments has been suspended’ while, on the other hand, the most recent news confirms the continuation of the sending of weapons systems under previous authorisations, contrary to what has been declared by the government and requested by Italian civil society (including the Peace Disarmament Network).

BANKS INVOLVED IN ITALIAN MILITARY EXPORTS

Unicredit is always the ‘most heavily armed bank’ followed again this year by IntesaSanpaolo, according to the tables in the 2024 Government Report on Italian arms exports, which show data on banking transactions relating to the year 2023, analysed by the ‘Armed Banks’ Campaign. The Report of the Ministry of Economy and Finance (MEF) in 2024 shows bank transactions related to arms export transactions for a total value of €3.976.491.881 in ‘reported amounts’ and €248.595.822 in ‘reported ancillary amounts’. It should be noted that, for years, the Report has not explained the conceptual and practical difference between these two amounts. The Report also indicates transactions of the banks relating to ‘Intergovernmental Programmes’ worth €1.904.411.249 and for ‘Global Licences’ worth €1.283.396.950

The largest transactions for exports of military systems were carried out by five banking groups: UniCredit reporting ‘reported amounts’ of €1.282.246.773 (30.9%); IntesaSanpaolo reporting ‘reported amounts’ of €729.205.590 euro (18.8%); Deutsche Bank for 766.235.419 euro (19.1%); Banca Popolare di Sondrio for 356.809.709 euro (8.5%) and Banca Nazionale del Lavoro for 225.199.389 euro (7.25%). It should be noted that UniCredit is also the leading banking group in the ranking of ‘Amounts for new transactions’ related to ‘Loans-Guarantees’ to military companies for arms exports (Table FG).

THE AMENDMENT OF 185/90 AND THE REDUCTION OF TRANSPARENCY

Due to the amendment of Law 185/90 currently being debated in Parliament (vote already taken in the Senate, debate underway in the Chamber) this type of analysis of the dynamics (and values) of Italian arms exports may become impossible. In fact, the government’s DDL that changes the current regulation is going to significantly erode transparency on this type of trade, reducing the types and amount of data that the Executive must transmit to Parliament, and even going so far as to completely eliminate the part of the Report relating to financial flows to banks.

In order to avoid such an unfortunate outcome – and to preserve the great transparency function that has characterised the application of Law 185/90 from the very beginning – the campaign ‘No more favours for arms dealers’ was activated, promoted in particular also by the Italian Peace Disarmament Network. Among the main demands of this civil society initiative (the elements of which will also be brought to the attention of the Chamber during specific hearings): to improve the overall transparency on arms exports by making the data in the Report to Parliament more complete and readable, and to prevent the complete deletion of the part of the Annual Report to Parliament that details the interaction between banks and military companies. The first result could be achieved by requesting that the Annual Report contain analytical indications by types, quantities, monetary values and recipient countries of authorised arms with explicit reference to the number of the MAE Authorisation (Maeci), the annual progress reports on exports, imports and transits of armament materials and on exports of services subject to the controls and authorisations provided by law.